The surge in Bitcoin has attracted much interest.

Over the last five years, it has soared from $US12 to over $US8000; this year it’s up 760%. Its enthusiasts see it as the currency of the future and increasingly as a way to instant riches with rapid price gains only reinforcing this view. An alternative view is that it is just another in a long string of bubbles in investment markets.

Bitcoin’s price in US dollars has risen exponentially in value in recent times as the enthusiasm about its replacement for paper currency and many other things has seen investors pile in with rapid price gains and increasing media attention reinforcing perceptions that it’s a way to instant riches.

However, there are serious grounds for caution. First, because Bitcoin produces no income and so has no yield, it’s impossible to value and unlike gold you can’t even touch it. This could mean that it could go to $100,000 but may only be worth $100.

Second, while the supply of Bitcoins is limited to 21 million by around 2140, lots of competition is popping up in the form of other crypto currencies. In fact, there is now over 1000 of them. A rising supply of such currencies will push their price down.

Third, governments are unlikely to give up their monopoly on legal tender (because of the “seigniorage” or profit it yields) and ordinary members of the public may not fully embrace crypto currencies unless they have government backing. In fact, many governments and central banks are already looking at establishing their own crypto currencies.

Regulators are likely to crack down on it over time given its use for money laundering and unregulated money raising. China has moved quickly on this front. Monetary authorities are also likely to be wary of the potential for monetary and financial instability that lots of alternative currencies pose.

Fourth, while Bitcoin may perform well as a medium of exchange it does not perform well as a store of value, which is another criteria for money. It has had numerous large 20% plus setbacks in value (five this year!) meaning huge loses if someone transfers funds into Bitcoin for a transaction – say to buy a house or a foreign investment – but it collapses in value before the transaction completes.

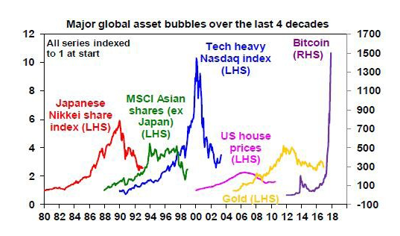

Finally, and related to this, it has all the hallmarks of a classic bubble. In short, a positive fundamental development (or “displacement”) in terms of a high tech replacement for paper currency, self-reinforcing price gains that are being accentuated by social media excitement, all convincing enthusiasts that the only way is up. Its price now looks very bubbly, particularly compared to past asset bubbles (see the following chart – note Bitcoin has to have its own axis!).

Because Bitcoin is impossible to value, it could keep going up for a long way yet as more gullible investors are sucked in on the belief that they are on the way to unlimited riches and those who don’t believe them just “don’t get it” (just like a previous generation said to “dot com” sceptics).

Maybe it’s just something each new generation of young investors has to go through – based on a thought that there is some way to instant riches and that their parents are just too square to believe it.

But the more it goes up, the greater the risk of a crash. Many people also still struggle to fully understand how it works and one big lesson from the Global Financial Crisis is that if you don’t fully understand something, you shouldn’t invest.

At this stage, a crash in Bitcoin is a long way from being able to crash the economy because unlike previous manias (Japan, Asian bubble, Nasdaq, US housing in the chart above) it does not have major linkages to the economy (eg it’s not associated with overinvestment in the economy like in tech or US housing, it is not used enough to threaten the global financial system and not enough people are exposed to it such that a bust will have major negative wealth effects or losses for banks).

However, the risks would grow if more and more “investors” are sucked in – with banks ending up with a heavy exposure if, say, heavy gearing was involved. At this stage, it’s unlikely that will occur for the simple reason that being just an alternative currency and means of payment won’t inspire the same level of enthusiasm that, say, tech stocks did in the late 1990s (where there was a real revolution going on).

That said, it’s dangerous to say it can’t happen. There was very little underpinning the Dutch tulip mania and it went for longer than many thought.

While crypto currencies and blockchain technology may have a lot to offer Bitcoin’s price is very bubbly.

Source: AMP Capital, December 2017. Paris Financial Services Pty Ltd is a Corporate Authorised Representative (No. 357928) of Capstone Financial Planning Pty Ltd. ABN 24 093 733 969 AFSL / ACL No: 223135. Information contained in this document is of a general nature only. It does not constitute financial or taxation advice. The information does not take into account your objectives, needs and circumstances. We recommend that you obtain investment and taxation advice specific to your investment objectives, financial situation and particular needs before making any investment decision or acting on any of the information con- tained in this document. Subject to law, Capstone Financial Planning nor their directors, employees or authorised representatives gives any representation or warranty as to the reliability, accuracy or completeness of the information; or accepts any responsibility for any person acting, or refraining from acting, on the basis of the information contained in this document.